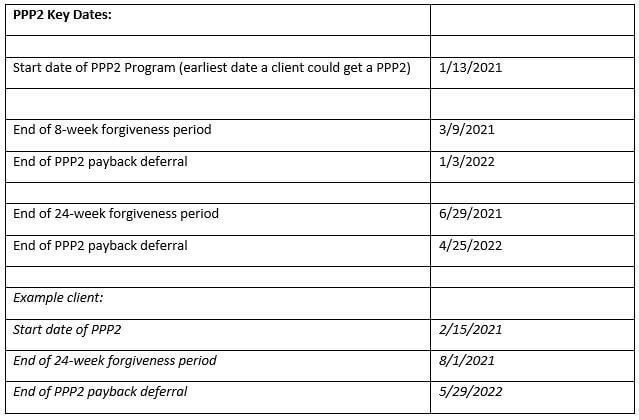

While many of the forgiveness rules released with the second wave of Paycheck Protection Program loans (PPP2) are the same as they were for the first round, there are some key dates to be aware of when planning forgiveness for your second-drawn loan.

Since it is September, most PPP2 forgiveness periods have ended. However, loan payments do not kick in for 10 months after the forgiveness period has ended.

Example:

You might have found it easier to use the 24-week forgiveness period option, which had the earliest end date of 6/29/21, as noted below. This means your loan payments do not kick in until 4/25/2022.

One consideration to keep in mind while submitting the forgiveness application is the interaction with the Employee Retention Credit (ERC). If you have an ERC during Q1-Q3 2021, you will want to talk to our team on the best way to maximize both the ERC and PPP2 before submitting a PPP2 forgiveness application.

For those wanting to submit PPP2 forgiveness applications, there is still plenty of time. Please contact your PKF Mueller representative to discuss your specific situation. As always, planning can help you maximize your financial situation and position you for greater success.

For more information please contact:

Scott Anderson, CPA, CTA

Manager, Consulting Services

COVID-19 Response Team Lead

sanderson@pkfmueller.com

+1 630 524 5259