More information will be coming soon from the IRS about the related to procedures for claiming credits and reporting sick pay.

Employers receive 100% reimbursement for paid leave pursuant to the Act.

- Health insurance costs are also included in the credit.

- Employers face no payroll tax liability.

- Self-employed individuals receive an equivalent credit.

Reimbursement will be quick and easy to obtain.

- An immediate dollar-for-dollar tax offset against payroll taxes will be provided.

- Where a refund is owed, the IRS will send the refund as quickly as possible.

Small Business Protection

Employers with fewer than 50 employees are eligible for an exemption from the requirements to provide leave to care for a child whose school is closed, or child care is unavailable in cases where the viability of the business is threatened.

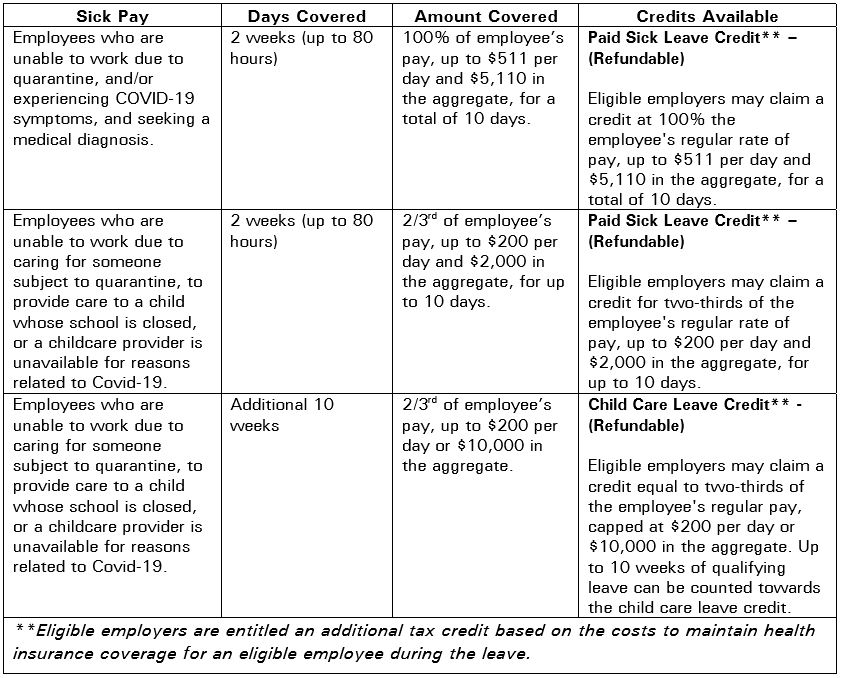

Sick pay

Eligible employers are businesses and tax-exempt organizations with fewer than 500 employees. (See exemption for employers with 50 or fewer employees above)

Sick pay:

- Required to withhold federal withholding, Social Security and Medicare.

- Eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS.

- Payroll taxes available for retention are federal income taxes, employee and employer share of Social Security, and Medicare Taxes.

- If payroll taxes retained are insufficient to cover the cost of sick pay, employers will be able to file a request for accelerated payment and receive reimbursement within two (2) weeks (more details to come related to procedures).

Example 1

Facts:

- Eligible employer pays $4,000 in qualified sick leave, and

- Required to deposit $7,000 in payroll taxes (including withholding from all employees),

Conclusion: The employer would only need to deposit $3,000 of its taxes ($7,000 less $4,000).

Example 2

Facts:

- Eligible employer pays $12,000 in sick leave, and

- Required to deposit $10,000 in payroll taxes (including withholding from all employees)

Conclusion: The employer could use the entire $10,000 of taxes in order to make qualified leave payments and file a request for an accelerated credit for the remaining $2,000.

For more information please contact:

Robin D. Linklater, MST, CPA

Tax Director

(312) 888-4629

rlinklater@muellercpa.com

or

Sheri Highland

Accounting Services Partner

(630) 242-1503

shighland@muellercpa.com