The 2022 tax-filing deadline is fast approaching for many not-for-profit organizations. If you operate on a calendar-year basis, your filing deadline is May 15, 2023. Otherwise, you must file by the 15th day of the fifth month following the close of your nonprofit’s fiscal year. Whichever deadline you’re aiming for, your tax records need to be organized (and, hopefully, by this time turned over to your tax preparer) so you’ll be able to file without any major hiccups.

Although nonprofits typically don’t owe tax, you’re required to report certain information to the IRS. If you don’t, you risk losing your tax-exempt status.

Why File?

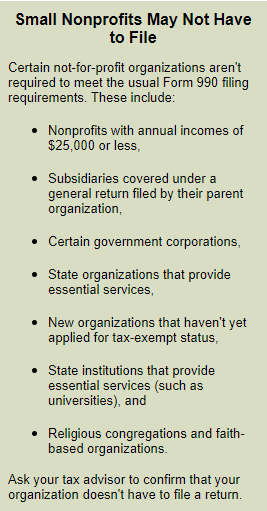

Most 501(c)(3) organizations are required to file an annual tax return with the IRS. However, there are a few exceptions (see “Small Nonprofits May Not Have to File” at right).

Why would your nonprofit need to file if you don’t owe tax? Form 990 contains valuable information relating to your organization’s mission, activities and financial status. This helps the IRS confirm that you’re complying with rules for tax-exempt organizations. Also, Form 990 information can be accessed by potential donors and grant makers, as well as members of the public.

Which Form?

Which form should your organization file? There are four variations of Form 990:

1. The standard Form 990 is used by nonprofits that:

- Have gross receipts of $200,000 or more or total assets of $500,000 or more,

- Are sponsoring organizations of one or more donor-advised funds,

- Are controlling organizations described in Section 512(b)(13),

- Operate one or more hospital facilities,

- Are nonprofit health insurance issuers described in Section 501(c)(29), or

- Are central or parent organizations filing a group return on behalf of subordinate organizations under a group exemption.

2. Form 990-EZ is a shorter version of Form 990 for organizations that have annual gross receipts of less than $200,000 and less than $500,000 in total assets at the end of their tax year.

3. Form 990-N (EZ Postcard) is an even simpler form that may be used by organizations with gross receipts of less than $50,000 annually.

4. Form 990-PF is for private foundations.

What If You Make Errors or File Late?

If a filed Form 990 contains errors or omits information, the IRS typically returns the form along with a letter requesting the accurate or missing information. It could potentially assess penalties.

Filing late can also result in penalties. The penalty amount generally depends on an organization’s annual gross receipts. If your nonprofit fails to file its return, the maximum penalty is the lesser of 5% of your gross receipts or $10,000 for the year. If you have more than $1 million in gross receipts annually, the penalty is equal to $100 per day to a maximum of $50,000.

Warning: If your organization fails to file its required return for three consecutive years, the IRS will automatically revoke your tax-exempt status. Should your nonprofit lose its exempt status, it becomes liable for federal income tax (and generally state income tax) on revenue. Also, donors will no longer be able to deduct their charitable contributions.

Fortunately, your organization can obtain an automatic extension to file. Simply file Form 8668, Application for Extension of Time to File an Exempt Organization Return, by your regular filing date to receive a six-month extension. This extension applies to Form 990, Form 990-EZ and Form 990-PF, but not Form 990-N (postcard). So if your nonprofit is due to file on May 15, 2023, your filing deadline would be pushed back to November 15, 2023.

What About UBIT?

All of this assumes that your organization doesn’t owe tax. But it’s possible that you’re liable for unrelated business income tax (UBIT) on income generated by activities outside the scope of your charitable mission. Separate rules apply to filings involving UBIT. For example, the tax must be reported on Form 990-T. Talk to your tax advisor for guidance on paying UBIT and avoiding activities that might trigger this tax.

Copyright © 2023