The IRS has issued new proposed regulations that define what constitutes real property to determine eligibility for tax-deferred Section 1031 “like-kind” exchanges. Importantly, the proposed regs allow personal property that’s deemed to be incidental to real property to be included in these exchanges. Here are the details.

TCJA Change

The Tax Cuts and Jobs Act (TCJA) permanently eliminated tax-favored Sec. 1031 like-kind treatment for exchanges of personal property that are completed after December 31, 2017. However, tax-favored Sec. 1031 treatment is still available for properly structured like-kind exchanges of real property held for business or investment purposes.

After the TCJA, the IRS has been forced to focus on what the like-kind requirement means in the context of real property exchanges, because only those exchanges still qualify for Sec. 1031 treatment. New proposed regulations attempt to clarify matters. An important takeaway is that any property that’s defined by the proposed regulations as real property can be exchanged under Sec. 1031 for any other property that’s defined by the proposed regulations as real property.

The rules in the proposed regulations would apply to real property exchanges that begin on or after the date the rules are issued in the form of final regulations. Until then, taxpayers can rely on the rules in the proposed regulations for real property exchanges that begin after December 31, 2017, and before final regulations are issued. Therefore, for all practical purposes, the rules in the proposed regs are retroactively effective.

Definition of Real Property

The term “real property” for purposes of a Sec. 1031 like-kind exchange means:

- Land,

- Improvements to land,

- Unsevered natural products of land, and

- Water and air space superjacent to (overlying) land.

For Sec. 1031 like-kind exchange purposes, an ownership interest in real property can include:

- Fee ownership,

- Co-ownership,

- A leasehold,

- An option to acquire real property, or

- An easement.

So, as long as you exchange an ownership interest in property on this list for another such ownership interest, the exchange will be considered a like-kind swap that qualifies for tax-deferred treatment under Sec. 1031 — if the exchange is properly structured.

Improvements to Land

The term “improvements to land” refers to inherently permanent structures and the structural components of them. An inherently permanent structure is any building or other structure that’s a distinct asset and permanently affixed to real property and that will ordinarily remain affixed indefinitely.

A building is any structure or edifice enclosing a space within its walls, and covered by a roof, the purpose of which is, for example, to provide shelter or housing, or to provide working, office, parking, display or sales space. Examples of buildings include:

- Houses,

- Apartments,

- Hotels and motels,

- Enclosed stadiums and arenas,

- Enclosed shopping malls,

- Factories and office buildings,

- Warehouses,

- Barns,

- Enclosed garages,

- Enclosed transportation stations and terminals, and

Stores.

Inherently permanent structures also include the following distinct assets, if permanently affixed:

- In-ground swimming pools,

- Roads, bridges and tunnels,

- Parking facilities,

- Paved parking areas and other paved surfaces,

- Special foundations,

- Stationary wharves and docks,

- Fences,

- Certain permanent lighting displays,

- Permanent outdoor lighting,

- Railroad tracks and signals,

- Telephone poles,

- Power generation and transmission facilities,

- Permanently installed telecommunications cables,

- Microwave transmission cell, broadcasting and electric transmission towers,

- Oil and gas pipelines,

- Offshore drilling platforms,

- Derricks, oil and gas storage tanks, and

- Grain storage bins and silos.

If a distinct asset isn’t listed above, the determination of whether it’s an inherently permanent structure is based on evaluating the following five factors:

- The manner in which the asset is affixed to real property,

- Whether the asset is designed to be removed or to remain in place,

- The damage that removal of the asset would cause to itself or the real property to which it’s affixed,

- Any circumstances suggesting that the asset wasn’t affixed for an indefinite period, and

- The time and expense that would be required to move the asset.

Distinct Assets

A distinct asset is analyzed separately from any other asset(s) to which the asset relates to determine if the asset should be classified as real property. In other words, whether it would be classified as land, an inherently permanent structure or as a structural component of an inherently permanent structure.

The determination of whether a separately identifiable item of property is a distinct asset is based on the facts and circumstances. In particular, the following four factors are considered:

- Whether the item is customarily sold or acquired as a single unit rather than as a component part of a larger asset,

- Whether the item can be separated from a larger asset, and if so, the cost of separating the item,

- Whether the item is commonly viewed as serving a useful function independent of a larger asset of which it is a part, and

- Whether separating the item from a larger asset of which it’s a part of would impair the functionality of the larger asset.

Unsevered Natural Products of Land

Real property can also include an unsevered natural product of land. Examples include:

- Crops, plants and timber,

- Mines,

- Wells, and

- Other natural deposits.

These items cease to be real property when they’re severed, extracted or removed from the land.

Personal Property Incidental to Real Property

Personal property is considered incidental to real property acquired in an exchange if:

- It’s typically transferred together with the related real property in standard commercial transactions, and

- Its aggregate fair market value doesn’t exceed 15% of the aggregate fair market value of the real property.

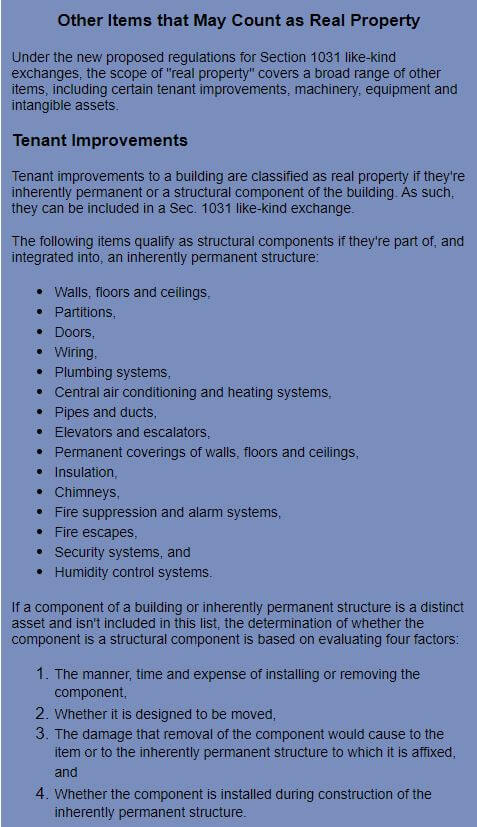

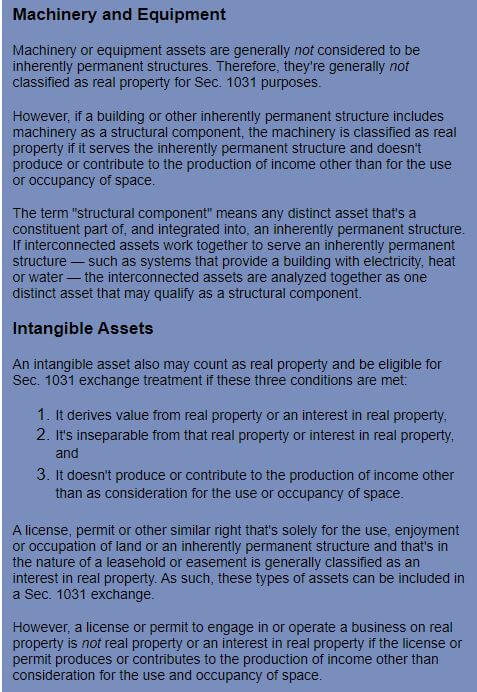

Personal property that passes these tests is classified as part and parcel of the associated real property and can be included in a Sec. 1031 like-kind exchange. Examples may include items listed as backup power generators, lighting fixtures, plumbing fixtures, carpeting, window treatments and tenant improvements. (See “Other Items that May Count as Real Property” below.)

For More Information

It’s important to remember that this guidance hasn’t yet been finalized. The proposed regs could elicit requests for additional guidance and exceptions. Contact your tax advisor if you have questions or want more information.

Copyright©2020