Medical expenses can be costly — and they’re not always covered by insurance. But there may be a silver lining: You may be able to claim an itemized deduction for the amounts you pay for medical, dental and vision care, if you incur enough costs to exceed the applicable threshold for the tax year. Here are the details about this deduction.

Raising the Bar on Medical Expense Deductions

You can claim an itemized deduction for medical, dental, and vision care expenses paid for you, your spouse and your dependents, to the extent those expenses exceeded 7.5% of your adjusted gross income (AGI). Filing a joint return isn’t necessary to take advantage of this provision based on the age of your spouse.

Deducting Expenses Paid for Supported Relatives

Do you pay medical expenses for a dependent parent, grandparent or adult child? If so, you can add those expenses to your own for itemized deduction purposes. For a person to be your dependent, you must pay over half of his or her support for the year.

If you pass the support test, you can add medical expenses you paid for the supported person to your own expenses for purposes of clearing the applicable AGI hurdle for medical expense write-offs. This is true even if you can’t claim a dependent exemption deduction for the supported person on your return because he or she has too much income.

What if you pay medical expenses for someone but don’t supply over half of his or her support for the year? In that case, you can’t combine that person’s medical expenses with your own for medical expense deduction purposes.

Counting Insurance Premiums

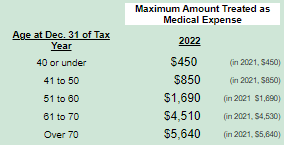

For itemized medical expense deduction purposes, you can include premiums paid for medical, dental and vision-care insurance. You can also include premiums paid for Medicare Parts A, B and D coverage and for Medigap policies. Finally, you can include premiums paid for qualified long-term care insurance policies, subject to the following age-based limits in 2022 (and 2021), which are adjusted annually for inflation:

Getting the Most from Your Medical Expense Deductions

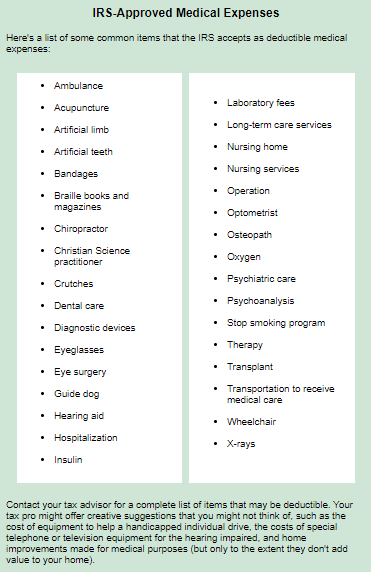

IRS rules regarding medical expense deductions have changed. For most taxpayers, it now takes more dental, medical and vision expenses than before to meet the AGI thresholds for these items. Whenever possible, try to pack as many doctor visits and non-emergency procedures into a single year, especially if it’s questionable whether or not you’ll meet the applicable AGI threshold.

Contact your tax advisor for more details. He or she can help ensure that you’ve met the applicable deduction threshold and included all IRS-approved medical expenses on your personal tax return.

Copyright © 2022