October 3, 2016

NO ADVANCE IN CONSUMER SPENDING

Personal spending was flat in August even as personal incomes rose 0.2%. These numbers from the Department of Commerce fell short of expectations: economists polled by MarketWatch had forecast a 0.2% gain in both categories. In other news linked to consumer spending, the federal government revised second-quarter GDP up to 1.4% in its third estimate; it had previously put Q2 growth at 1.1%.

HOUSEHOLD CONFIDENCE IMPROVES

September brought a big jump in the Conference Board’s closely watched consumer confidence index, which rose 3.0 points to 104.1. The University of Michigan’s consumer sentiment index ended September at 91.2, up from 89.8 at the end of August; the main factor in that gain was an improved outlook among higher-income households.

NEW HOME SALES DIP 7.6%

This housing indicator tends to be very volatile, and this August retreat follows a 13.8% July advance. The median new home price was down 5.3% in August from a year earlier, the Census Bureau noted. Looking at other real estate data, the July edition of the 20-city S&P/Case-Shiller home price index showed a 5.0% annual increase in existing home values, ticking down from 5.1% in June; the National Association of Realtors said that pending home sales fell 2.4% in August.

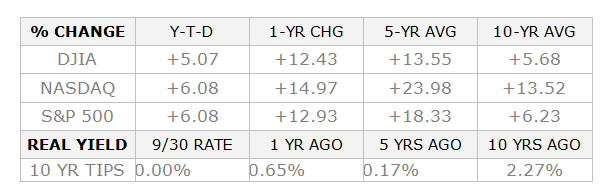

MINOR GAINS IN A WEEK OF MAJOR UPS & DOWNS

The last week of September saw the three major U.S. equity indices advance. The Dow Jones Industrial Average rose 0.26%; the S&P 500 gained 0.17%; and the Nasdaq Composite added 0.12%. The September 30 settlements: Dow, 18,308.15; S&P, 2,168.27; Nasdaq, 5,312.00.

THIS WEEK: Monday offers ISM’s September manufacturing PMI and quarterly results from The Container Store. Tuesday, Wall Street considers earnings from Darden Restaurants and Micron Technology. On Wednesday, ISM releases its September service sector PMI; ADP issues its September payrolls report; data on August factory orders appears; and Constellation Brands, Monsanto, and Yum! Brands announce earnings. In addition to a new initial jobless claims report, Thursday brings the latest Challenger job-cut data and Q3 results from Ruby Tuesday. Friday, the focus turns to the Department of Labor’s September jobs report.

Sources: wsj.com, bigcharts.com, treasury.gov – 9/30/16

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Securities offered through 1st Global Capital Corp., Member FINRA/SIPC. Investment advisory services including fee-based asset management accounts held through NFS, LLC are offered through 1st Global Advisors, Inc. All other financial planning and fixed insurance services are offered through Mueller Financial Services, Inc. Mueller Financial Services, Inc. and 1st Global Capital Corp are unaffiliated entities.