All businesses need more cash. It’s not easy to produce more working capital from a well-run business. However, by electing LIFO, you can reduce taxable income and pay less tax. The tax you save becomes cash in your pocket. With LIFO, you can benefit from inflation.

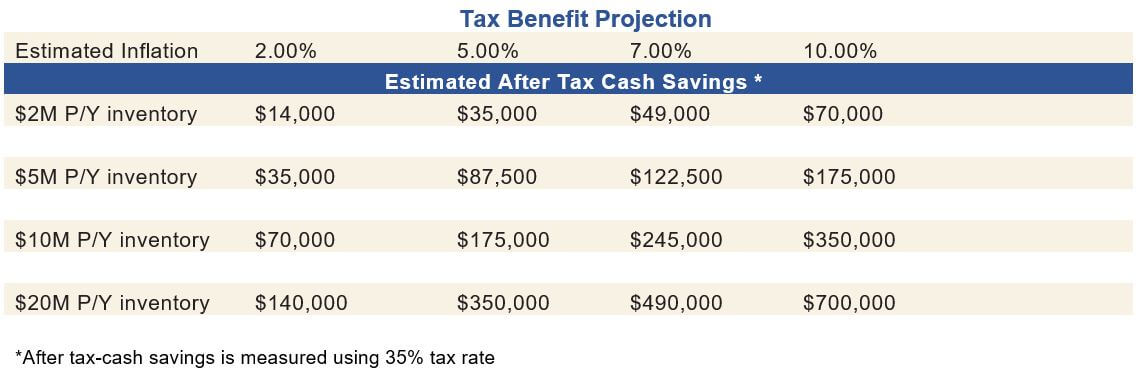

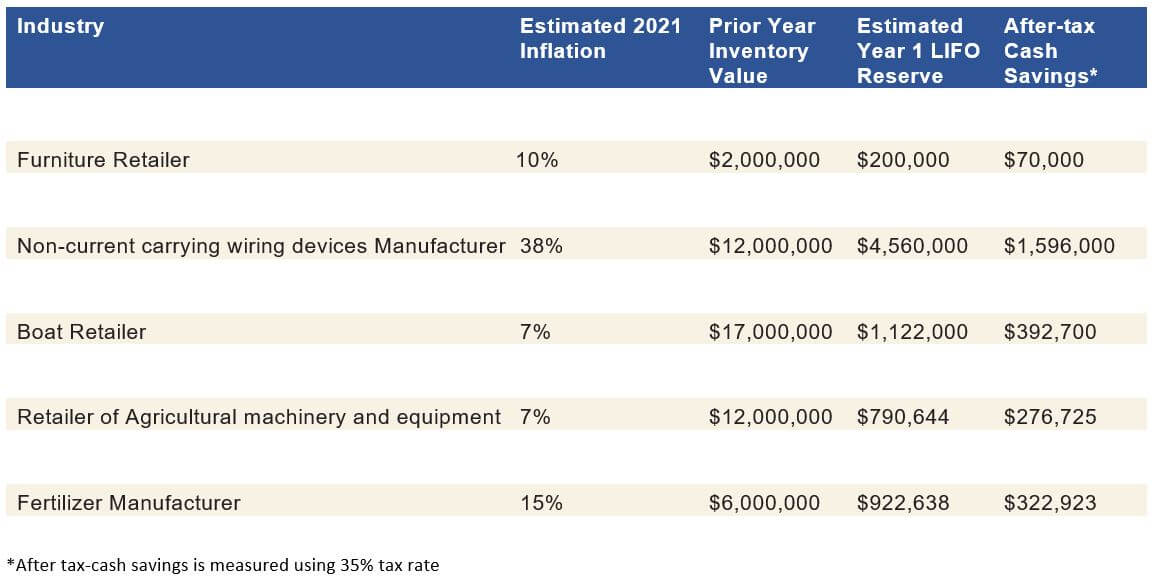

Whether your clients are manufacturers, distributors, or retailers, they have the opportunity to mitigate the current negative impact of price increases and save money annually by using the Last-In-First-Out (LIFO) inventory method. Adopting LIFO removes the negative consequences of inflation, lowering tax liability and creating cash for reinvestment. Any business with over $2M in inventory that is experiencing inflation is a qualified candidate for electing LIFO. Depending on the inflation rate and the inventory level, a taxpayer’s cash savings can be quite substantial.

WE MAKE LIFO SIMPLE:

Inventory is the largest single item on the balance sheet for many companies. During times of inflation, LIFO accounting can provide substantial benefits. Inflation and higher inventory values can diminish your profits by increasing your taxes. LIFO accounting uses them to build a fund of cash that you can use to grow your business. Best of all, the LIFO process does not interfere with the ordinary course of business. LIFO is typically computed at year-end and only impacts accounting records. Nothing changes but the way you report income.

LIFO BENEFIT:

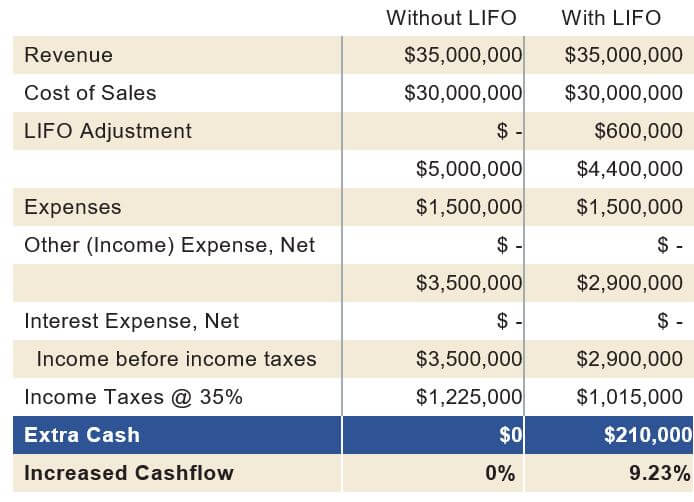

LIFO subtracts inflation from inventory costs, which increases the cost of goods sold and decreases taxable income. The LIFO benefit grows annually as inflation widens the gap between current and the past-year inventory costs. This gap is called the LIFO reserve. The tax savings from the yearly deduction can be invested separately or re-invested in the business. In the below example, because LIFO is a non-cash expense, the $210,000 reduction in income taxes is the only effect on cash flow.

Who is a good candidate for LIFO?

• Any company already using LIFO.

• Any company not using LIFO: Carry inventory of at least $2M.

• Any Profitable company.

• Any company experiencing inflation in their industry.

Requirements to Use LIFO – Initial Election

• Tax return attachment – Form 970.

• Conformity requirement – LIFO adjustment for GAAP.

• Inventory must be valued at cost.

Many industries are currently experiencing inflation. An analysis of LIFO benefits is seamless and provided at no cost to you. Businesses of all types are taking advantage of LIFO. Contact us today for our assistance!

For more information, please contact:

Mark Gerros, CPA

Tax Manager

mgerros@pkfmueller.com

+1 773 828 6542